In Part 1 of this series, we discussed the problems that RSA wine faces in trying to increase its miniscule (.25%) market share in the United States (US). To mix an old metaphor, “in the US the dogs are not eating the RSA dog food”. Unfortunate, but true. That aside, the major market potential that beckons most strongly is Peoples Republic of China (PRC or just China) and to a far lesser degree, certain other Asian countries, such as Japan, Vietnam, and Singapore, to name three). Reportedly over 70% of the growth in expected international wine sales will be in this Asian area for the next 10 or more years. Of course, this potential is known by all wine producing regions in the world, and the resulting competition is and will continue to be intense.

Far and away, the greatest market potential for substantial wine sales growth lies with China. The number of Chinese drinkers consuming imported wine more than doubled from 19 million to 48 million people between 2011 and 2017 alone, according to a study by consultants Wine Intelligence. At present, only 4% of the total alcoholic beverages consumed annually in China are wines, and no more than 64% of total wine consumed is domestically produced. As a point of reference, in the US roughly 70% of the wine consumed is domestically produced. Further, only 33% of the US adult population drinks wine, and one third of wine drinkers (say 11- 12% of the population) drink almost 90% of wine consumed. On basis of these numbers, tripling the number of wine drinkers (from 4% to 12%) in China appears long term realistic. China is clearly in its infancy as a wine consuming country, but that status can change reasonably quickly, as it has for autos, fashionable clothing, travel and many other luxury goods. (Long term may be more like 5-10 years, not 20 or more …)

Far and away, the greatest market potential for substantial wine sales growth lies with China. The number of Chinese drinkers consuming imported wine more than doubled from 19 million to 48 million people between 2011 and 2017 alone, according to a study by consultants Wine Intelligence. At present, only 4% of the total alcoholic beverages consumed annually in China are wines, and no more than 64% of total wine consumed is domestically produced. As a point of reference, in the US roughly 70% of the wine consumed is domestically produced. Further, only 33% of the US adult population drinks wine, and one third of wine drinkers (say 11- 12% of the population) drink almost 90% of wine consumed. On basis of these numbers, tripling the number of wine drinkers (from 4% to 12%) in China appears long term realistic. China is clearly in its infancy as a wine consuming country, but that status can change reasonably quickly, as it has for autos, fashionable clothing, travel and many other luxury goods. (Long term may be more like 5-10 years, not 20 or more …)

Per the internationally respected OIV, as of 2015 China’s per capita consumption of wine was 1.4 liters/year, the lowest of 21 wine drinking nations reported, and yet China was also the 5th greatest wine consuming nation at 17.25 million hl/year. If in perhaps the next 10 years, per capita wine consumption in China doubles (to 2.4 L/yr per capita), reflecting a 7.2% annual growth rate, a conservative expectation based on growth rates of recent years, and the fact it would still be well less than comparable Japan’s per capita consumption is 3.2 L/yr, China’s total annual consumption would be 34.5 million hl/yr, greater than the entire US consumption and make it the largest wine consuming nation in the world. Even if total wine imports did nothing more but hold a 33% (if not greater) present market share, imported wine sales would be 11.5 million hl, or almost 16.7 million nine liter cases. From any standpoint, this is a lot of wine.

An exceptionally astute discussion of the Chinese wine market (other than a typo in its headline) was published by June 28, 2017, by Jim Boyce, publisher of the Grape Wall of China. (See: http://www.grapewallofchina.com/2017/06/28/les-miserables-rvfs-annaul-china-wine-tasting-is-a-reality-check/ From his vantage point in Beijing, Boyce has been publishing the Grape Wall newsletter for the past 10 years and he always provides great insight into murky areas. For example, “Last year, China imported 625 million liters of bulk and bottled wine, according to China customs, while local production was listed at 1.1 billion liters. That gave imports a 36 percent share.” But further, he states “… local production is overstated and, in turn that imports now have half or more of the market.” If so, domestic wine production and the total wine being consumed in China is somewhat overstated and the per capita consumption as well.

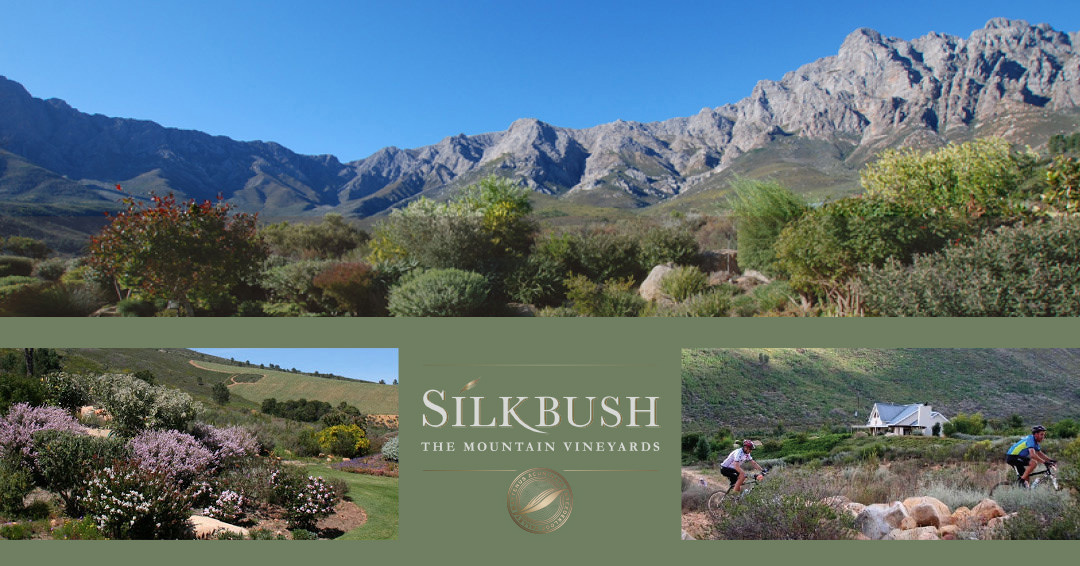

While China is growing their domestic wine production (almost all Cabernet Sauvignon), imported wine represents close to 100% of the perceived “quality” wine market. Accordingly, wine drinkers will start with inexpensive, lower quality domestic wine and then aspire and graduate to more expensive, higher quality imports. So the big questions that standout are: if the consumption of wine in China grows by at least a 7.2% annual rate, how much of the increased consumption will be imported and which wine producing regions will increase their sales most substantially? How might RSA wines fare, and (especially Silkbush) how can our brother African wineries and we obtain a larger sliver of this exciting market?

Increased wine sales in China will be strongly influenced by wine education, wine region awareness, and ultimately brand awareness, both for domestic and imported wines. But for imported wines, tax policies and absolute pricing will have significant roles as well. Both former colonies of Hong Kong and Macau scrapped tariffs on wines in 2008, while in mainland China, imported wines are subject to excise tax, tariff and VAT that roughly adds up to almost 50% of the wine’s import value.

We were pleased to see the recent announcement by COFCO Wine & Spirits, the second largest Chinese wine importer, that they would soon import the Boschendal and Tall Horse brands of DGB, a very large South African producer. In 2016, China imported 9.6 million liters of bottled South African wine, making it the sixth largest RSA destination in the world.

Nevertheless, due to the disparate tax arrangements, there is a major incentive to smuggle wine from Hong Kong into the PRC. In June 2017, Chinese Customs announced the arrest of 29 suspects and confiscation of 490 tons of contraband worth US $33.8 million. Another case involving four smuggling rings and 1,800 tons of wine is ongoing. Since smuggled wine would not be in the reported numbers, this would suggest the consumption of total imported wine in China may be somewhat underreported.

Note further, because vast quantities of average quality bulk wine are available on world markets for less than $1/liter, it is reasonable to assume many domestic Chinese wineries will import and blend foreign wines into their products, improving their overall quality with relatively low investment cost. Because there is no 14% tariff on Chilean wine, reportedly 86% of the 49.1 million liters of bulk wine that were imported to China in 2016 came from Chile. Depending on how fast and to what extent bulk importation/blending occurs, the market for bottled/branded imported wines may be slower than otherwise anticipated. (Point of fact: the country’s bulk wine importation grew 29.99% in value year-on-year, first five months of 2017, to US$53.3 million, while its volume climbed 7.5% to 60.4 million liters.)

Not only does the Chinese wine market potential dwarf all other international markets, the international demand for wine in most other countries is expected to remain flat at best. A regarded study reports that in 1975, the average French citizen’s wine consumption was 100 liters per year. In 2016, the numbers were shockingly lower, with average consumption at only 47 liters per person, with an expectation to go down to 43.63 liters in 2020. Consumption levels of red wine have reportedly gone down over 12% over the past three years alone. Worldwide wine consumption has grown 0.4%, with 266 million hectoliters consumed in 2016. The message to wineries that have growth aspirations is clear: get into selling wine in China, sell more locally to loyal friends and customers, or acknowledge your aspirations are unrealistic and get out of the business entirely.

(We will discuss Hong Kong wine aspects and its significance at length in the next part of this series.)